American Pharoah: A Stable Investment

On June 6th, American Pharoah won the Triple Crown in horse racing after clinching victory at the Belmont Stakes. Only 11 other horses have claimed this honor, and it’s been 37 years since it had last happened.

Often people ask why winning the Triple Crown is said to be a thoroughbred racehorse’s greatest honor; the answer lies in the close proximity of the race dates and the distances of those races. Taking place over a 5 week period, the Kentucky Derby and Preakness Stakes are both roughly 1 1/4 mile races while the Belmont Stakes increases the distance by an additional 1/4 mile. There are horses who perform well on the shorter tracks and others that fare better on the longer tracks, very few are capable of winning both.

The sport of horse racing is most commonly associated with gambling – that is unless you own one of the horses in the race and then you most likely associate the race with a return on your investment. That’s right they aren’t in it just for the fame – they’re also in it for the money. Let’s peel back the curtain and see what the owner of the Triple Crown winning thoroughbred looks to benefit as a result of this great honor.

American Pharoah by the numbers

American Pharoah was purchased in 2013 for $300,000 by Ingordo Bloodstock, acting as an agent for Ahmed Zayat. Earning over $4.5 million through his racing career, American Pharoah has barely scratched his potential earnings. While 4.5 million is nothing to scoff at, American Pharoah’s real worth won’t require racing another lap.

American Pharoah’s breeding rights were sold at an undisclosed amount (although amounts of at least $20 million had been turned down) and the stud fee is expected to be around $175,000 per foal. Arguably the most famous horse to ever race, Secretariat, sired 600 foals in his lifetime. At $175,000 per foal – that would amount to $105 million earned in total stud fees, a number that completely dwarfs American Pharoah’s racing career earnings thus far.

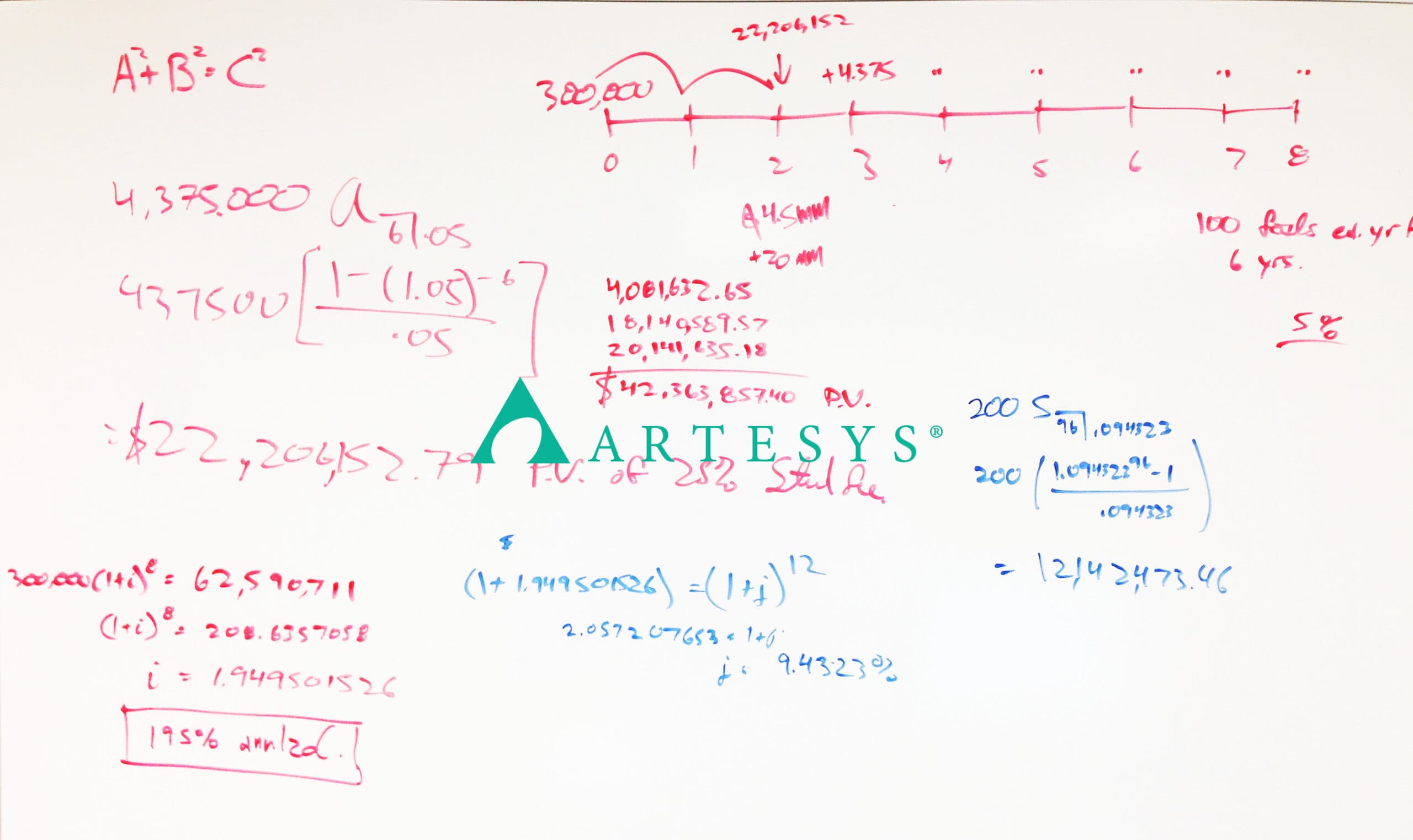

The breeding rights were purchased by Ashford Stud, a North American Stallion breeder. If the estimates of 100 foals per year hold true, American Pharoah will be bringing in $17.5 million each year in stud fees. Similar breeding right deals would allow Zayat a 25% cut of the stud fees, equating to roughly $4.375 million per year over the next 6 years in stud fee revenue. American Pharoah’s stud fees alone would yield Ahmed a present value estimate of roughly $22.2 million today.

Ahmed Zayat’s ROI

For the purposes of this post we are going to exclude all associated expenses to get a rough idea of Ahmed’s ROI is on his $300,000 purchase of American Pharoah

American Pharoah has accumulated $4.5 million in race earnings, an assumed $20 million in breeding rights, and an estimated $4.375 million each year in stud fees for the next six years. That would mean Amed’s purchase of American Pharoah has a net present value of just over $42 million dollars today (assuming a 5% annual interest rate).

The 8-year annual compounded interest rate for Ahmed’s investment will be 195% per year compared to that of the S&P 500‘s current 8-year annualized return of approximately 7.09%.

Capturing the Triple Crown was not only a rare honor, but a once in a lifetime investment for American Pharoah’s owner.

Just for fun

If you were to save $200 a month for 8 years, and were able to match Ahmed’s rate of return (195% annually). You would amass a “small” fortune of $12 million in just 8 years.

It’s fun to dream.